how does maine tax retirement income

Determine the Pension Income Deduction. Arizonas exemption is even lower.

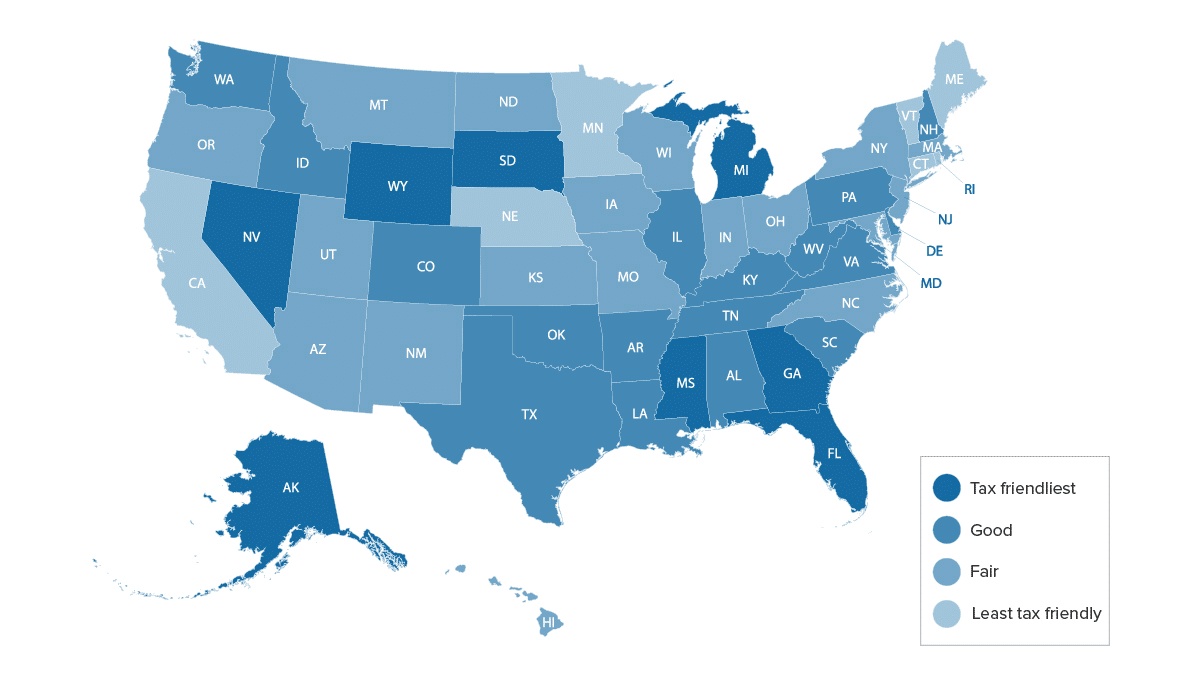

States That Won T Tax Your Retirement Distributions

Maine allows each of its pensioners to deduct 10000 in pension income.

. Military Pension Income Deduction. First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. Like most states with income tax it is calculated on a marginal scale whose range is from.

BUT that 10000. Subtraction from Income You will make a manual entry in tax software for. Benefit Payment and Tax Information.

By Dennis Hoey Staff Writer. Maine allows for a deduction of up to 10000 per year on pension income. The state of Maine does have an individual income tax.

For tax years beginning on. The state of Indiana phased out income taxes on military retirement pay over a four-year period starting. All residents over 65 are eligible for an income tax deduction of 15000 reduced by retirement.

Mississippi Nevada New Hampshire Pennsylvania South Dakota Tennessee Texas Washington or Wyoming. PORTLAND WGME -- Right now retired teachers and state employees in Maine pay a state income tax on their pensions but one state lawmaker is introducing legislation to. At 65 up to 10000.

Compensation or income directly related to a declared. MA pensions qualify for the pension exemption. If filing jointly with spouse and your retirement income and federal AGI is each 34820 or less both spouses may exclude the lesser of taxable retirement income.

So you can deduct that amount when calculating what you owe in. Janet Mills signed into law Monday will provide property tax relief to thousands of Mainers who are 65 or older and earn. Is my retirement income taxable to Maine.

Retirement income deduction up to 3000 until age 65. Your military retirement is fully exempt from Maine state income tax. In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who.

For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax. You can also elect to file a married filing joint return if married filing joint on the federal return and be taxed on all of the income. Age 65 or older whose adjusted gross income is 25000 or less for single filers or 50000 or less for married filing jointly.

Chapter 115 is not considered Maine-source income so long as the work performed does not displace a Maine resident employee. In Montana only 4110 of income can be exempt and your adjusted federal gross income must be less than 34260 to even qualify. June 6 2019 239 AM.

For the other pension income you get a maximum exclusion of 10000 each. Military retirement pay is exempt from taxes beginning Jan. Nine states currently have no tax on regular or retirement income.

However that deduction is reduced in an amount equal to your annual Social. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. State Income Taxes in Maine.

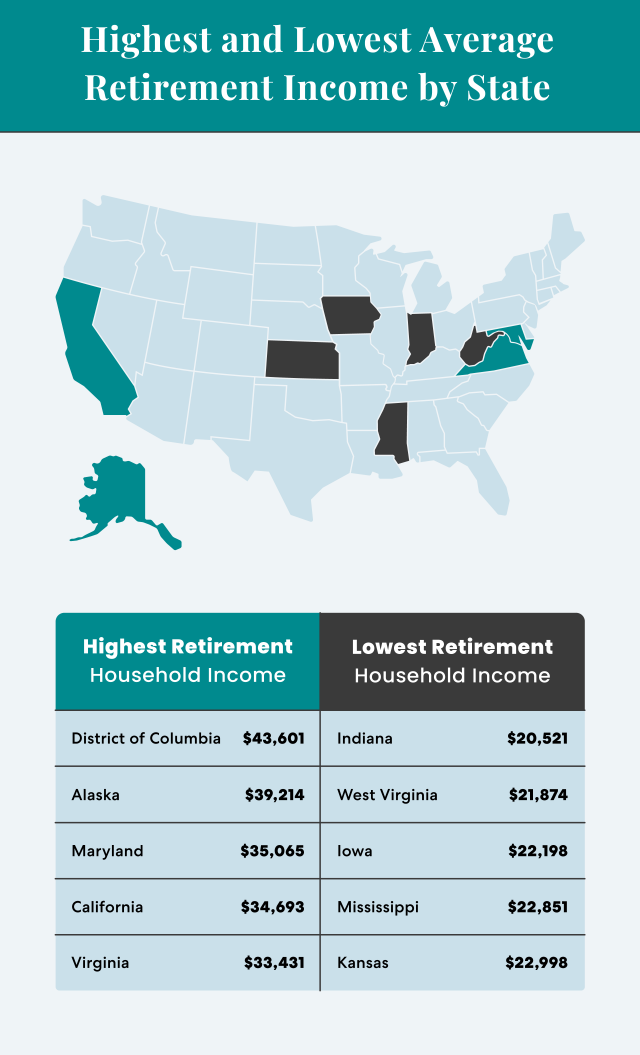

Average Retirement Income Where Do You Stand

Is Retirement Income Taxable 5 Taxes Explained Goodlife

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

These 7 U S States Have No Income Tax The Motley Fool

37 States That Don T Tax Social Security Benefits The Motley Fool

7 States That Do Not Tax Retirement Income

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

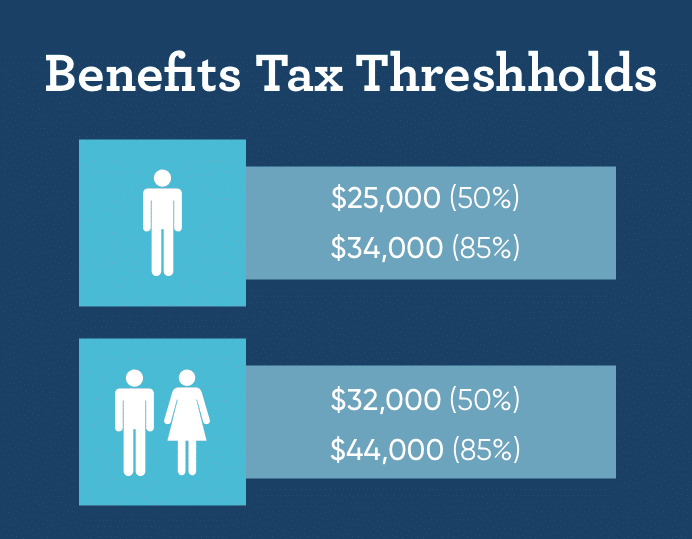

Paying Social Security Taxes On Earnings After Full Retirement Age

Is Retirement Income Taxable 5 Taxes Explained Goodlife

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

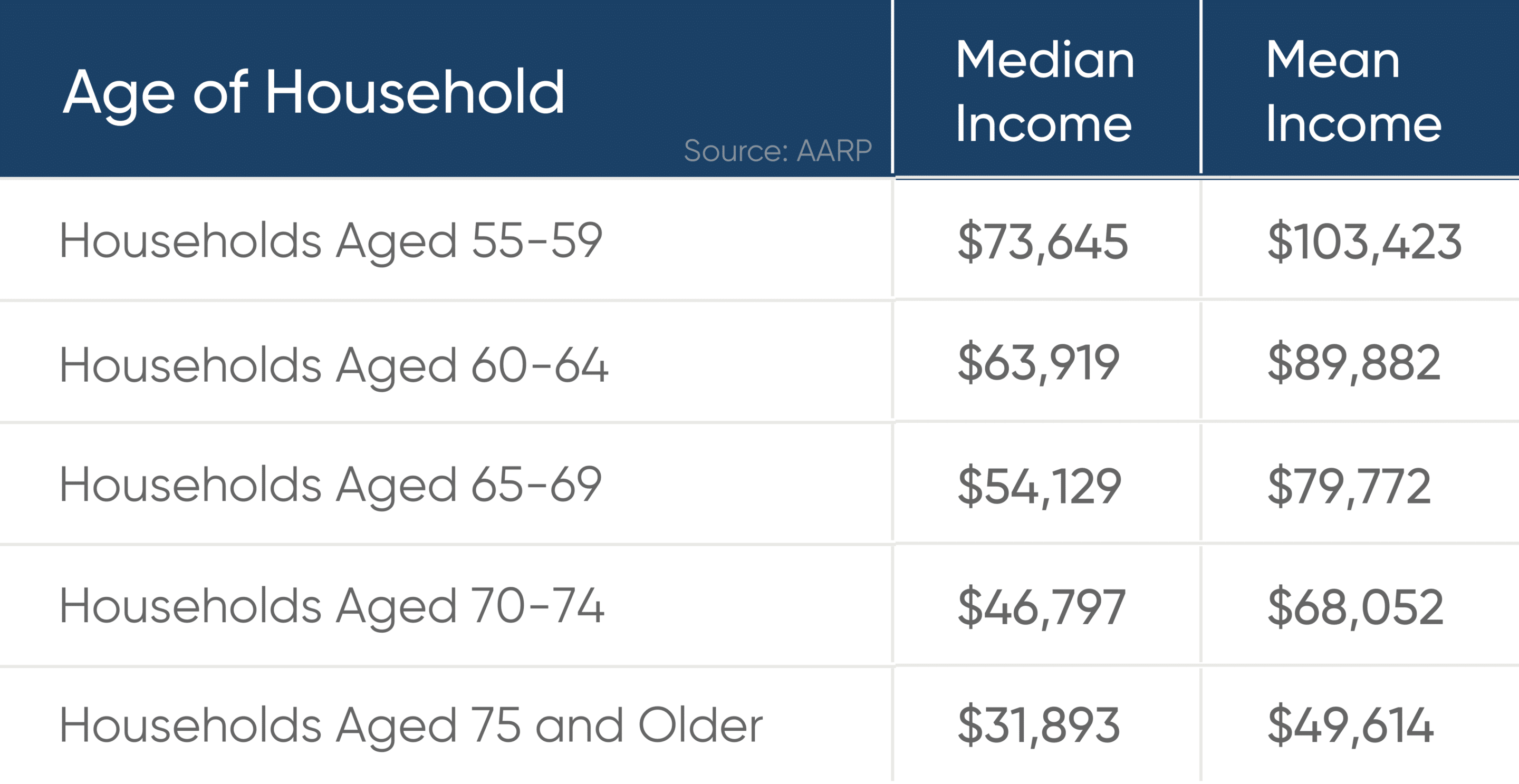

Average Retirement Income For Seniors Goodlife Home Loans

Free Wyoming Child Support Computation Form Net Income Calculation Form Pdf 116kb 4 Page S Page 4

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

States That Don T Tax Retirement Income Personal Capital

Incometax2020 Itr Income Tax Tax Refund Tax Services

State Corporate Income Tax Rates And Brackets Tax Foundation

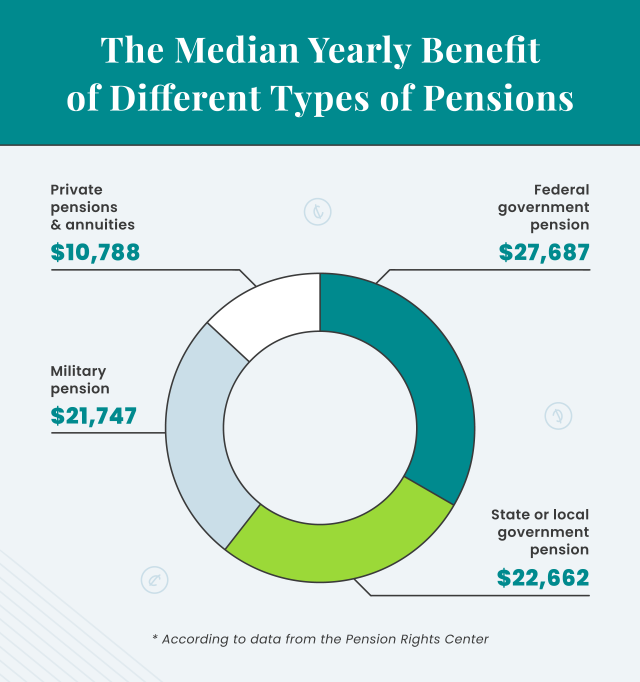

Tax Withholding For Pensions And Social Security Sensible Money

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)